Fears that the impact of the pandemic on technology adoption will exacerbate the UK’s problem of persistently weak productivity growth are not necessarily justified. Recent evidence gives cause for cautious optimism, as many firms try to ‘innovate their way out of the crisis’.

In 1665, just like today, the Great Plague created the need for social distancing in universities. Isaac Newton had to return from Trinity College, Cambridge, to his childhood home where, in a ‘year of wonders’, he went on to formulate differential calculus and a theory of universal gravitation. But even if bad times can foster frontier innovation, do they stimulate or retard the adoption of existing technologies?

Low technology adoption in UK businesses has been an issue before Covid-19

The Covid-19 crisis occurs against a background of persistently poor productivity in the UK compared with both its international peers and its history prior to the global financial crisis of 2007-09 (Valero and Van Reenen, 2019). Given this dismal performance, it is unsurprising that real wages had barely recovered to their 2007 level, even before the pandemic hit.

To some extent, the ‘productivity puzzle’ of recent years has been an international phenomenon – productivity growth has slowed across advanced economies since 2008. Technology optimists consider that once emerging technologies – such as artificial intelligence – diffuse through the economy, we will see a new wave of productivity growth (Brynjolfsson et al, 2018). This view relies on complementary managerial practices becoming more widespread.

Others are more pessimistic, arguing that new technologies have less productivity impact than those that preceded them (for example, Cowen, 2011; Gordon, 2018).

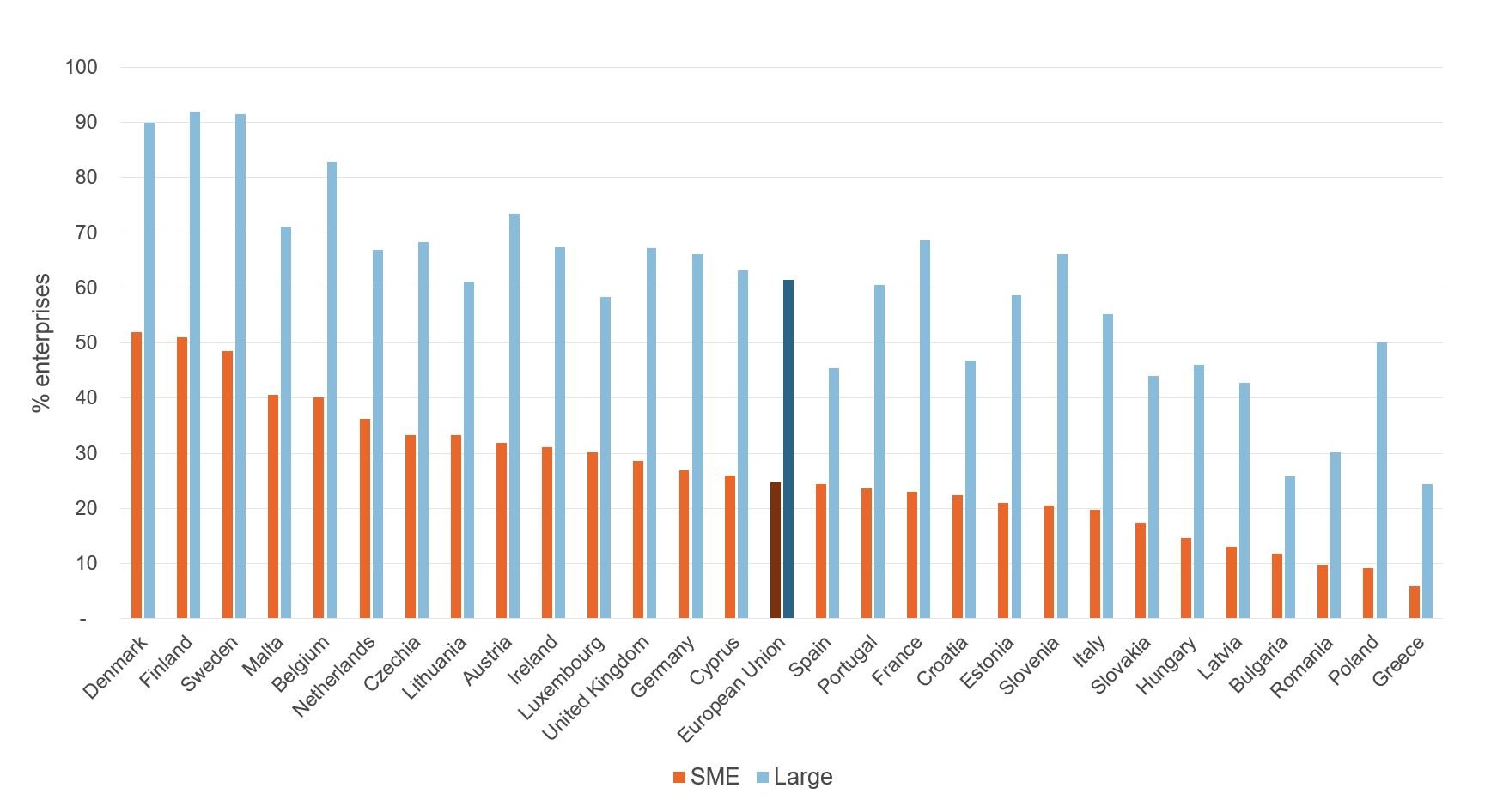

The UK’s productivity performance has been particularly poor compared with other advanced countries, and our relatively low investment, including in the adoption of more established productivity-enhancing technologies, appears to be part of the explanation. According to the World Economic Forum’s World Competitiveness report (2019) ‘ICT [information and communications technology] adoption, while increasing, remains low by OECD standards: the country ranks 31st globally and only 16th in Europe’. Similarly, the European Commission’s Digital Scoreboard shows that digital intensity among UK enterprises is middling relative to EU countries though larger firms do relatively better than their larger counterparts (see Figure 1).

Accordingly, there has been a new policy focus on improving technology adoption in the ‘long tail’ of small and medium-sized enterprises (SMEs). This includes new initiatives such as ‘Be the Business’ (BTB) and the ‘BEIS Business Basics programme’.

Figure 1: Enterprises with high levels of digital intensity, by size (2019)

Note: Data extracted from European Commission, Digital Scoreboard; and based on Eurostat – Community survey on ICT usage and eCommerce in Enterprises. Digital Intensity score is based on counting how many out of 12 key digital technologies are used by each enterprise. High levels are attributed to those enterprises using at least seven of the listed digital technologies. More information can be found here.

What can economic theory tell us about the downsides?

Mainstream economic theory would suggest that the pandemic should slow technology adoption. First, Covid-19 and the restrictions to contain it have had a major negative effect on demand. The Office for Budget Responsibility (OBR, 2020) predicts that UK GDP will shrink by over 11% in 2020 – the largest drop in annual output since the Great Frost of 1709. Falling demand reduces the return to investments, including those in technology, as there are fewer customers to buy any increase in output. This dulls the incentive to invest in new equipment, premises or training.

Second, it is not just that demand is lower, but uncertainty is higher. Since investing in new technologies is irreversible, firms are likely to delay making decisions until this uncertainty gets resolved. There is a growing body of evidence that uncertainty has a large chilling effect on investment.

Third, there has been a large hit to company cash flows. Capital markets are imperfect as revealed by the banking crisis and a multitude of empirical studies. Hence, hits to liquidity will also constrain investment and these might be particularly so for risky investment in new technologies, especially for SMEs.

Finally, the huge amount of managerial time absorbed dealing with the immediate Covid-19 crisis is likely to take time away from considering longer-run strategic issues around new technologies.

Are there any upsides, in theory?

Thankfully, there are some countervailing forces. First, firms are investing in new technologies to deal with the disruption. For example, with so many employees working from home, firms may respond by investing in software platforms that facilitate meetings and scheduling (like Zoom) and producing with less face-to-face interaction by using automated technologies like robotics. Enabling easier online shopping is vital when people do not or cannot visit offline retail stores. These are investments of necessity – things firms have been forced to do – so standard theory would say firms are still worse off post-Covid-19, it is just that their responses offset some of the loss.

Second, the impact of the pandemic is likely to be harder on less efficient, low-tech firms. Experience of other bad times, such as recessions and trade shocks, suggests that less productive firms will shrink and contract most. If the resources are reallocated towards more productive and higher tech firms, this ‘creative destruction’ effect will raise aggregate productivity and technology intensity.

But if the human and capital assets are not fully reallocated, productivity will tend to rise simply as average runs would if a cricket team fielded only its best batters, leaving players on the bench. But this is not good for wellbeing, as productivity rises only because the least productive people are excluded from the economy. A well-functioning economy, like a good team, needs all its players on the field.

There is research suggesting that some positive activities could emerge from bad times. Certainly, there are impressive examples of firms responding to the pandemic by adapting and adopting new ideas. Local restaurants using their wholesale supply chains to market fresh produce direct to the public, for example.

This idea has been formalised using an idea from motor racing. In good times when it is easy to sell, firms do things that save time but cost money (Hall, 2009). But in bad times firms, can switch their idle resources into reorganising, taking a 'pit stop'. This idea has been used to understand why there often appear to be surprisingly large amounts of innovation in recessions and after the Chinese import shock (for example, Babina et al, 2020; Aghion and Saint-Paul, 1998; Bloom et al, 2016).

Therefore, the theory on the impact of Covid-19 on adoption is more nuanced than one might think. What does the empirical evidence say?

Early evidence suggests that the Covid-19 crisis has accelerated adoption

Several survey-based analyses suggest that Covid-19 has accelerated the adoption of technologies. In a survey of UK businesses conducted by the Centre for Economic Performance (CEP) and the Confederation of British Industry (CBI), Riom and Valero (2020) find that more than 60% of firms have adopted new digital technologies (such as remote working technologies or cloud computing) or new management practices since the start of the pandemic, and nearly 40% have invested in new digital capabilities (such as e-commerce or advanced analytics). Most respondents stated that the pandemic prompted or accelerated these changes.

Adoption rates were higher in larger firms and for those that had adopted new digital technologies or capabilities in the three years prior to the crisis (even after controlling for size and other key business characteristics). While London-based businesses were more likely to have adopted digital technologies, there was no clear regional pattern to the other types of innovation measured.

How do these types of adoption rates compare to the pre-Covid-19 period? The most recent UK Innovation Survey found that just under 13% of businesses were ‘process innovators’ over the three years up to December 2018 (defined as making ‘significant changes in the way that goods or services are produced or provided’ – that is, adoption of things that are new to the business rather than the economy.

Looking at the time series, the survey suggests that adoption fell in the years following the global financial crisis, and began rising again from 2012 before falling in the most recent period (see Figure 2). This pro-cyclicality is consistent with the mainstream theories discussed above, and hints that the pandemic may be different from a more usual business downturn.

Figure 2: Percentage of businesses engaging in process innovation, 2008-10 to 2016-18

Notes: Sourced from statistical annexes for each of the UKIS. Large businesses have 250+ employees. SMEs have 10-249 employees.

Other studies also find that Covid-19 has accelerated the adoption of digital technologies. BTB and McKinsey find that UK SMEs significantly accelerated their adoption of technology, undergoing ‘three years’ worth of innovation in just three months of the lockdown period’ (BTB/McKinsey, 2020). Another recent survey of small businesses with fewer than ten employees shows that across different types of digital technologies, between 10-20% of micro-businesses have started using them since the crisis (and these rates are higher for the larger firms within this category) (BTB/Lloyds, 2020).

Will this short-term response last?

In general, it appears that businesses expect these changes to outlive the crisis. Riom and Valero (2020) find that the vast majority (over 90%) of innovating firms intend to keep such changes in place once the immediate crisis is over. BTB/McKinsey (2020) report that 45% of SMEs expressed willingness to invest in technology post-Covid-19; and BTB/Lloyds (2020) find that of those that have started using/are using more of digital technologies, the majority intend to carry on using them.

Several factors will influence the technological trajectory of UK firms. The largest share of respondents in the CEP-CBI survey (nearly 40%) considered macroeconomic uncertainty relating to Covid-19 and Brexit to be a major barrier to adoption (consistent with the theory discussion above), and a further 35% consider it a minor barrier (see Figure 2).

Despite significant recent progress in the development of vaccines, the timing and shape of the recovery remains uncertain, as does the extent to which new working patterns, consumer behaviours and business models are here to stay with implications for the future of our cities (Nathan and Overman, 2020). As Covid-19 uncertainty recedes with the new vaccines this might help cement in changes (although forces related to Brexit push in the opposite direction).

In line with the earlier discussion, businesses consistently report that financing/cost constraints are key barriers to innovation (broadly defined, see UK Innovation Survey, 2019) and the longer the crisis lasts; the more these are likely to be felt. Indeed, financing constraints were the second most reported barrier to adoption in Riom and Valero (2020) – see Figure 3.

Figure 3: Barriers to process innovation

Notes: Riom and Valero (2020). Share of respondents that considered each to be a major/minor barrier to adopting new technologies, capabilities or management practices.

A drawback of the existing surveys is that they focus on the ‘extensive margin’ (whether or not businesses adopt new technologies) rather than the ‘intensive margin’ (how successfully technology that has been adopted is embedded in the business). In addition, the early evidence has asked how existing firms have responded to the crisis. Going forward, tracking effects on new entry (and exit) through the reallocation effects discussed above are critical.

What will be the impact of Covid-19 on the invention of new technologies?

The positive response of firms to the crisis in terms of technology adoption (and the introduction of new products) in the short term can be contrasted with the impacts on more long-term innovation activities such as research and development (R&D). A survey conducted in June/July 2020 found that nearly 80% of Innovate UK grant-holders had either stopped or reduced R&D activity due to immediate disruptions (Roper and Vorley, 2020). In addition, a survey of 200 businesses in June, found that commitment to innovation-led initiatives had decreased as companies focus on short-term issues (McKinsey, 2020).

The Covid-19 crisis creates new risks for innovation in firms particularly for those facing new financing constraints (Roper and Turner, 2020). A number of studies have shown that R&D activity tends to suffer in downturns, and Aghion et al (2012) find that this was particularly the case for credit constrained firms following the financial crisis (OECD, 2012).

There is also evidence that the pandemic is shaping the direction of innovation. The pandemic has stimulated R&D in a number of areas including vaccine development, ventilators and personal protective equipment. US patent applications show that Covid-19 has shifted the direction of innovation toward new technologies that support video conferencing, telecommuting, remote interactivity and working from home (Bloom et al, 2020).

Importantly, this highlights the extent of what can be achieved when the public and private sector work in partnership to address urgent social challenges. Lessons from this experience should now be applied to climate change (Stern et al, 2020). Indeed, there are many areas where the UK has international comparative advantage in clean technologies and where the economic benefits for the UK appear to be large (Martin et al, 2020).

What should policy-makers do?

Policy should address the barriers – both new and pre-existing – to technology adoption. Increasing focus on the evaluation of business support programmes and incentives in recent years has begun to shed light on what works. To date, we know relatively more about stimulating innovation than its diffusion (Bloom et al, 2019; Bravo-Biosca and Stouffs, 2018).

While the pandemic may have changed things, the need for monitoring and evaluating technology support policies, and adjusting them in light of evolving evidence is as important as ever. Given rising unemployment and labour market displacement the pandemic has caused (together with concerns over 'forced automation' in certain sectors), programmes to encourage technology adoption must run hand-in-hand with those to train and ‘reskill’ the workforce (Li et al, 2020) for a smarter, more inclusive and sustainable future.

Where can I find out more?

- Innovation in the time of Covid-19: Businesses have rapidly adopted new technologies and new ways of working in response to the massive disruptions caused by the pandemic. A Centre for Economic Performance report by Capucine Riom and Anna Valero suggests that if such innovation continues, it could boost the UK economy in the long term.

- The COVID crisis and productivity growth: Against the backdrop of a 15-year-long productivity growth slowdown, Filippo di Mauro and Chad Syverson consider the channels through which the crisis might shift the growth rates of productivity and output. Globalisation, labour mobility and small firms may all fall victim to the crisis if the world does not succeed in re-opening borders, refraining from trade and currency wars and focusing on policies to boost productivity. On the upside, the broad adoption of new technologies – such as IT skills during the epidemic – and strong reallocation pressures may provide an independent boost to productivity as we come out of the crisis.

- Innovation for a strong and sustainable recovery: In the recovery from Covid-19, innovation and diffusion will be key to addressing several structural challenges facing the UK economy. Ralf Martin, Sam Unsworth, Anna Valero and Dennis Verhoeven analyse patent data to identify areas where the UK has comparative advantage in innovation, and where the economic returns in the UK might be large, highlighting technologies that are relevant for two key social challenges: net zero and dealing with the pandemic.

- Building back better: policies for a strong and sustainable recovery: Sam Unsworth and Anna Valero argue that there’s an opportunity to build a new social contract, tackle inequality, foster innovation and adopt a long-term industrial strategy.

- Covid-19 has blown apart the myth of Silicon Valley innovation: Writing at MIT Technology Review, David Rotman says that the pandemic shows that the United States is no longer much good at coming up with technologies relevant to our most basic needs.

- The case for a COVID-19 carbon tax: Ralf Martin and John Van Reenen explain how a carbon tax could both help pay for the enormous costs of the pandemic and encourage ‘clean’ investment. Crucially, it should be levied in a few years’ time, when the UK economy has begun to recover.

Who are experts on this question?

- Nick Bloom

- Erik Brynjolfsson

- Chiara Criscuolo

- Chad Syverson

- Anna Valero

- John Van Reenen