By acting fast, coordinated policy can create jobs and steer a resilient, inclusive and sustainable recovery from the Covid-19 crisis. The alternative of a prolonged global depression and unmanaged climate change would be profoundly damaging.

Pulling the world out of recession means restoring confidence. As the UK emerges from the crisis phase of the Covid-19 pandemic, the government will need to introduce a comprehensive stimulus package – a set of policies that aim to boost economic activity – to promote recovery. Avoiding protracted depression and making progress on climate change will depend significantly on choices about the policies that are introduced over the coming six months.

As well as policies to restore spending and jobs, there are growing calls for government to implement policies that encourage us to ‘build back better’ and avoid a return to the low productivity and stagnant wage growth that characterised the recovery from the last recession.

It will also be important to ensure that the package of policies and reforms does not worsen what is a bigger and longer-lasting crisis: climate change. Policy should support the UK’s climate and long-term ‘net zero’ transformation objectives. Economic theory and experience tell us that it is possible to achieve strong, sustainable, resilient and inclusive growth – and that the opportunities for doing so are growing. The experience of Covid-19 tells us that risk and resilience will need to be centre stage.

What does evidence from economic research tell us?

- For advanced economies that can borrow in their own currency, the most affordable way out of recession, when interest rates are close to zero, is for the government to borrow and invest.

- Low wage growth and growing inequalities in wealth and access to public services such as transport, education, health, justice and housing have driven a growing sense of injustice, which has undermined trust in institutions and threatened the social contract.

- Restoring confidence is a prerequisite for encouraging short-term spending and long-term investment in sustainable capacity.

- Sustainable, resilient and inclusive investments have some very appealing short- and long-run characteristics in generating growth.

- Underinvestment in – and lack of measurement of – key assets, including social and natural capital, undermines prosperity.

How reliable is the evidence?

Restoring confidence will require policy reform including public spending together with the framing of a much better vision of the future (Gurria, 2020). A key objective of any recovery package should be to stabilise expectations and channel surplus desired saving into productive investment (Zenghelis, 2016).

Restoring confidence requires harnessing the growth potential of an inclusive, resilient and resource-efficient economy. Research has highlighted opportunities associated with sustainable growth (New Climate Economy, 2014; Rydge et al, 2018), but Covid-19 increases the urgency of shifting to a better growth model.

Concerns about repaying enlarged public debt and limited ‘fiscal space’ must be addressed head on (Llewellyn and Zenghelis, 2020). A premature tightening of public budgets is likely to make debt sustainability harder to achieve and risks crashing the economy.

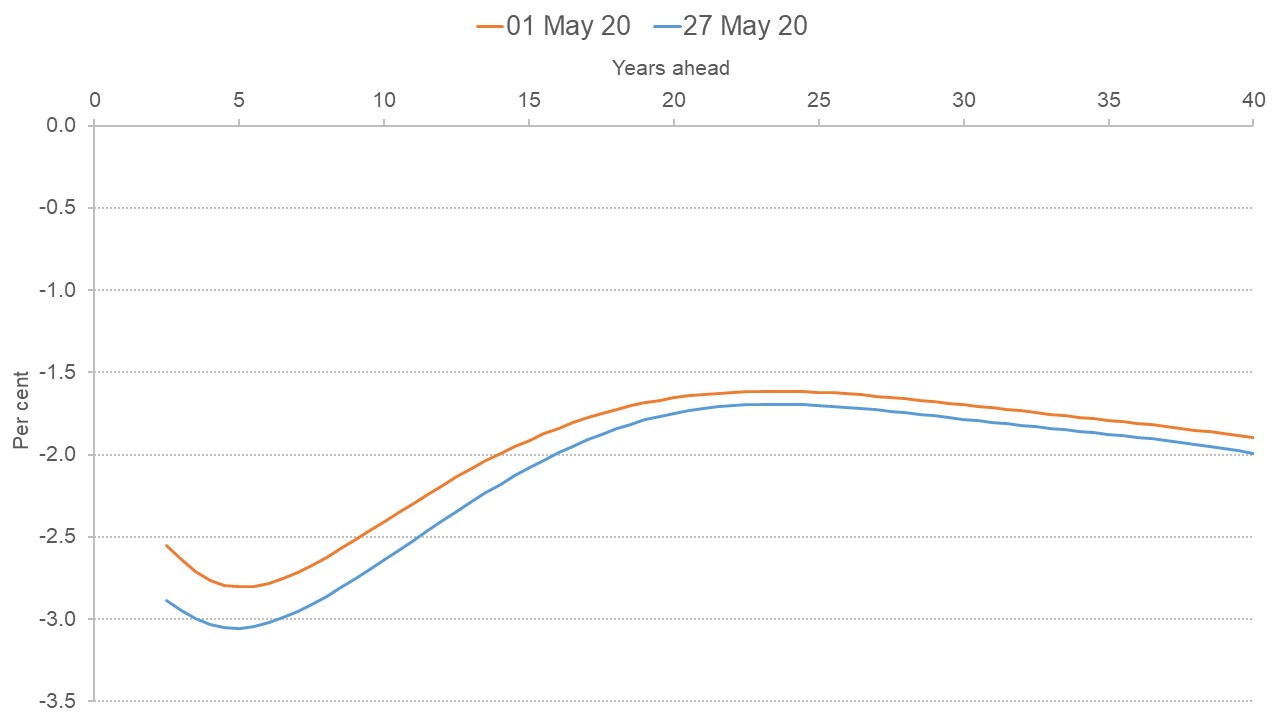

Higher debt remains historically affordable (Zenghelis, 2020). The UK sold negative-yielding government bonds for the first time in May, and the market expects real bond rates to remain below zero, reflecting abundant investor appetite for public debt to support investment (see Figure 1).

Figure1. UK instantaneous implied real forward curve (gilts)

Source: Bank of England calculations

Stabilising the ratio of public debt to GDP requires growth to boost the denominator and raise the revenues to stabilise growth in the numerator. Only by generating growth does public debt become sustainable and easily repayable. The alternative is depression and instability.

Public borrowing in a recession has been shown to deliver a strong bang for every publicly borrowed buck (Auerbach and Gorodnichenko, 2012). When resources are under-employed, public expenditure has a large multiplier effect (Blanchard and Leigh, 2013). Each percentage point of GDP spent on investment can be expected to increase GDP ultimately by around 2-3% (Hepburn et al, 2020) raising public revenues sufficient to find the borrowing.

Related question: What is the size of the fiscal multiplier?

The need for investment

In the short run, investment is necessary to get people back to work and stimulate domestic spending and demand (Zenghelis, 2020). In the long run, structural investment in key assets increases their resilience to future shocks, expands capacity and fosters productivity growth (IMF, 2014).

Clean innovation, working with the technologies of the future, is particularly effective at generating productivity gains from discovery (Aghion et al, 2012). We have already had a glimpse of this in the dramatic declines observed in the costs of renewable energy, battery storage and electric vehicles (Henbest, 2020).

There are many more such opportunities to come, but credible public policy plays a central role in guiding investors (Van der Meijden and Smulders, 2017; Zenghelis, 2019). The credibility of markets driven or heavily regulated by the public sector, such as those relating to energy infrastructure, transport, buildings and the environment, is predominantly within policy-makers’ control. Consequently, mixed or muddled signals on policy intent and the design of policy frameworks will deter investment and raise the risk premia charged.

By contrast, using public money to prop up fossil-fuel intensive infrastructure with limited productivity potential is likely to prove very wasteful (Carbon Tracker, 2020).

Investment in human capital will also be required to enable workers affected by change to secure the skills and jobs necessary for the twenty-first century economy (Robins et al, 2019). Covid-19 has reminded the world of the urgent need to strengthen the quality and resilience of natural assets. Economic activity that leads to unsustainable use of natural capital contributes to pandemics (Settele et al, 2020).

Investment in social capital (Zenghelis, 2019) is also necessary to deliver effective and functional government with popular support. The Office for National Statistics (ONS) will need extra funding to develop better measures of broad asset stocks as metrics for sustainability (Zenghelis et al, 2020).

Sustainable investment policies perform particularly well against these criteria (Houser et al, 2009). In the short run, clean energy infrastructure is particularly labour-intensive, creating twice as many jobs per dollar spent than fossil fuel investments (Pollin et al, 2008). Construction projects like insulation retrofits and building wind turbines are less import-intensive than many traditional stimulus measures and lead to higher multipliers, while lowering long-term energy costs (CCC, 2020; Jacobs, 2012).

Incentives for green recovery strategies

Carbon pricing and environmental taxation can help tilt incentives to support green recovery strategies and generate valuable revenues while increasing economic efficiency (Burke et al, 2020). It will be very hard to achieve the UK’s climate commitments, including to net zero emissions, without a strong and effective carbon price.

The UK has an established carbon pricing framework (Vivid Economics, 2019), but reforms are needed to bring the plethora of overlapping carbon pricing policies into one uniform price across the economy, and ensure price levels are in line with the UK’s climate objectives.

Reinforcing the UK’s carbon pricing regime to ensure prices are consistent with net zero suggests a politically feasible carbon price starting at around £40 per tCO2 in 2020 and rising to £100 per tCO2, or more, in 2050. This can be imposed through an explicit carbon tax or the auctioning of emissions allowances. Either would raise public revenue of around £20 billion a year until the early 2030s (Burke et al, 2019).

Now is an opportune time to adjust carbon price levels. Disruption from the crisis and lower fossil fuel prices makes it easier, temporarily, to redirect economic systems in a zero-carbon direction, and a strong carbon price can help to guide recovery decisions (Burke et al, 2020).

A carbon price is necessary for deep decarbonisation, but not sufficient (Stiglitz-Stern Commission, 2017). Other policies will include resource efficiency regulations and standards and green public procurement (Romani et al, 2011) as well as support for innovation (Vogt-Schilb et al, 2017).

Institutional initiatives

Sound institutions can boost confidence and reduce the cost of capital, by sharing and reducing risk (Baker et al, 2015). The UK should capitalise on institutional success stories – such as the Climate Change Act and the Committee on Climate Change independently holding UK government to account – and replicate them in areas in need of better coordination, measurement and evaluation (LSE Growth Commission, 2017).

A UK National Investment Bank, with a sustainability mandate to scale private finance, would help to overcome capital market failures. It could leverage both domestic and international sources of private finance by managing projects, creating platforms for scaling new technologies, reducing and managing policy risk and helping overcome financial barriers to long term investment (Armitt, 2020).

Direct public support for new infrastructure needs to be matched by regulation to maintain investment and protect consumers from ‘rent-seeking’. Strengthening the Competition and Markets Authority is necessary to prevent concentration when large liquid firms acquire small viable firms facing financial difficulty under lockdown.

Covid-19 is increasing the role of the state in the economy through the process of rescue loans and equity stakes in many companies. Industrial policy thereby has an enhanced role (Mundaca and Richter, 2015).

Related question: What is the likely future role of the state in the UK economy?

The government should bring together the existing Industrial Strategy and Clean Growth Strategy to create a single forward-looking and coherent plan for strengthening the UK’s human capital for the recovery and the low-carbon transition. Bailout conditionalities can save jobs, ensure workers are trained for the twenty first century economy, and accelerate low-carbon restructuring, particularly in polluting firms hit hard by the pandemic (O’Callaghan and Hepburn, 2020).

Changing behaviour

Finally, the reaction to the crisis has shown the possibility of rapid changes in ways of doing things. It offers an opportunity to embed climate- and productivity positive behaviours (Reeves et al, 2020). This includes changes to travel routines, virtual learning and healthcare, efficient and clean use of urban space and investment in the circular economy to reduce reliance on fragile supply lines, noting that independence does not equate to security. For essentials, such as medical supplies, food and energy, global connectivity and collaboration enhance resilience (Stavins et al, 2020).

Some behavioural change will be incompatible with emissions reductions. For example, there is anecdotal evidence from China of people shifting from public transport into cars, raising the spectre of the hollowing out of cities and renewed desire for urban sprawl at the expense of public transport.

What else do we need to know?

This is a truly global pandemic with a truly global economic impact, the likes of which we have not experienced before. No country is isolated. There is an urgent need for a coordinated response, in the UK and internationally, to avoid a global depression, to bolster resilience to future pandemics and to build back better.

A sustainable recovery also requires multilateral coordination from the OECD, the International Monetary Fund, the World Bank and regional development banks at a time when unilateral politics is in the ascendancy.

By acting fast, coordinated policy can create jobs and steer a resilient, inclusive and sustainable recovery. The alternative of a prolonged global depression and unmanaged climate change would be profoundly damaging.

Where can I find out more?

Will Covid-19 fiscal recovery packages accelerate or retard progress on climate change? An Oxford Review of Economic Policy study outlines five policy priorities with high economic multipliers and climate impact.

A net-zero emissions economic recovery from Covid-19: Experts from leading UK universities argue that the UK could lead by example with a recovery package including components on net zero buildings, energy storage, clean industry, transport and greenhouse gas removal.

From containment to recovery: environmental responses to the Covid-19 pandemic: The OECD shows how measures to tackle Covid-19 could also address pressing environmental challenges and improve the environmental health and resilience of societies.

Designing the Covid-19 recovery for a safer and more resilient world: Joaquin Levy and colleagues explore seven concrete fiscal and economic policy areas designed to green the economic recovery.

Who are UK experts on this question?

- Dimitri Zenghelis

- Nicholas Stern, Chair of the Grantham Research Institute, London School of Economics

- John Llewellyn, Llewellyn Consulting