World trade typically falls far more than world GDP in a global downturn, but then bounces back quickly. Early indications suggest that the contraction in trade in the looming Covid-19 recession will be even bigger than what followed the 2007/08 global financial crisis.

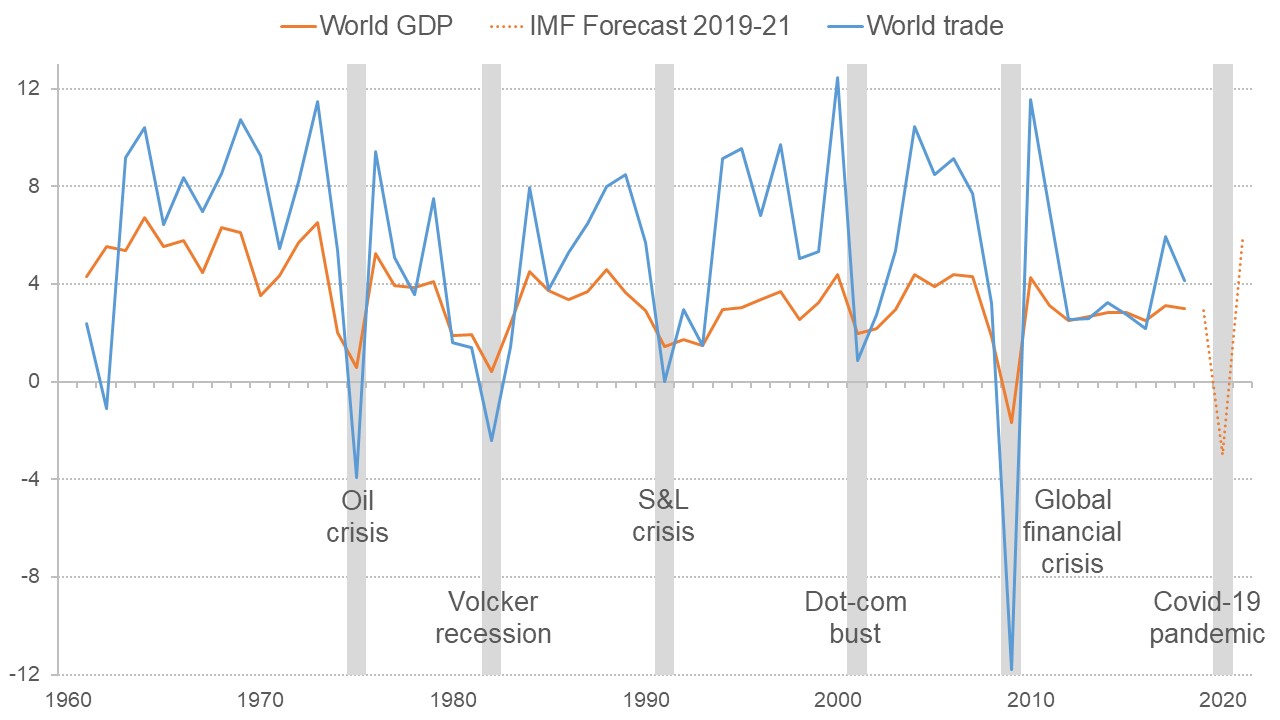

Before the Covid-19 pandemic, there had been five global downturns since the end of the Second World War. These episodes are shown as grey-shaded areas in Figure 1. World trade declined significantly more than world GDP in each downturn: on average, for every percentage point decline in the growth of world GDP, world trade growth fell by two percentage points.

Figure 1: World GDP growth and world trade growth since 1960

Sources: Data on GDP and imports in 2010 US$ for 201 countries and territories from the World Bank’s World Development Indicators. Global downturns (grey-shaded areas) are defined as in Freund (2009): world real GDP growth below 2%, and at least 1.5 percentage points below the average of the previous 5 years.

In its April 2020 World Economic Outlook, the International Monetary Fund (IMF) forecast a collapse in global growth as a result of the measures put in place around the world to contain the Covid-19 pandemic. The IMF expects world GDP to shrink by 3% in 2020, down from a growth rate of 3% in 2019. Should this forecast prove correct, based on past experience, it would not be surprising to see a decline in world trade by 8% in 2020, down from a growth rate of 4% in 2019.

During the downturn that followed the 2007/08 global financial crisis, world trade fell especially dramatically. This spawned a body of research investigating the causes of what became known as the ‘Great Trade Collapse’.

What does evidence from economic research tell us?

- Economists have identified a number of factors that may have contributed to the ‘Great Trade Collapse’. Speaking to concerns about a rise in protectionism, one contemporary study documents that G20 countries increased the number of product lines subject to temporary trade barriers by 25% during 2008/09 (Bown, 2011). But the overall rise in protectionism during this episode was low by historical standards (Bown and Crowley, 2013).

- Other studies highlight that the international trade of financially vulnerable firms and sectors was affected especially strongly (Amiti and Weinstein, 2011; Antràs and Foley, 2015; and Chor and Manova, 2012). Their findings indicate that the credit crunch caused by the global financial crisis contributed to the ‘Great Trade Collapse’.

- But the bulk of the ‘Collapse’ appears to have been due to changes in the composition of spending during the recession (Bems et al, 2010; Bems et al, 2013; Eaton et al, 2016). As the world entered an economic downturn, consumers and firms slashed their expenditure on durable goods. Since durable goods account for an outsized portion of international trade, this precipitated a large drop in trade.

- A noteworthy feature of the last five global downturns, visible in Figure 1, is that trade has tended to bounced back as strongly in the recovery as it collapsed in the recession. As a result, trade quickly recovered its pre-crisis trend as the world economy returned to full health.

How reliable is the evidence – and how applicable is it to the current crisis?

The pattern that world trade growth slows by two percentage points for every one percentage point fall in world GDP has been documented in numerous studies, and used by professional forecasters in past global downturns (Freund, 2009). Moreover, the especially large decline of spending on durable and investment goods during recessions is one of the ‘business cycle facts’ that has been observed across countries and during different historical periods (Hodrick and Prescott, 1997; Basu and Taylor, 1999).

The evidence from the 2008/09 ‘Great Trade Collapse’ strongly suggests that these two regularities are linked: since durable goods are especially trade-intensive, the more-than-proportional decline in durables spending in recessions can explain why trade falls more than world GDP in a global downturn, but also recovers rapidly in the subsequent upswing without leaving permanent scars.

Yet any inference from past evidence about how trade will behave during the looming global recession must confront a problem of ‘small numbers’: there have only been five global downturns during the past 70 years, each set against a specific historical backdrop. The Covid-19 crisis differs from these episodes in ways that may materially shape its impact on global trade in the short and long run.

On the one hand, the social distancing measures put in place to contain the Covid-19 epidemic have hit services unusually hard. Services still only account for 20% of world trade, according to Eurostat and IMF statistics (Eurostat, 2019). It is thus possible that the coming recession will be led by a sector that contributes a small portion of global trade, and that world trade overall will hold up better relative to world GDP than in past global downturns.

On the other hand, quarantine and social distancing measures represent an unprecedented shock to the productive capacity and trade infrastructure of the world’s largest economies (Baldwin, 2020). They may spread more powerfully across the globe as a result of tightly integrated production networks across countries. (Baldwin and Freeman, 2020).

The measures also come at a time in which trade policy has taken a generally more protectionist turn (Baldwin and Evenett, 2020). Disruptions to production and international commerce, uncertainty over future trade policy and outright protectionism may cause a deeper and more persistent decline in world trade than in previous downturns.

The early indications are that the contraction in global trade will be severe. The latest forecasts by the World Trade Organization (WTO) see a 13% decline in global trade as an ‘optimistic scenario’ (WTO, 2020) Consistent with this, real-time evidence from maritime shipping compiled by IMF researchers shows that international trade in vehicles – one type of durable good – was down 30% in May 2020 compared with the past three years (Cerdeiro et al, 2020).

What does this imply for policy?

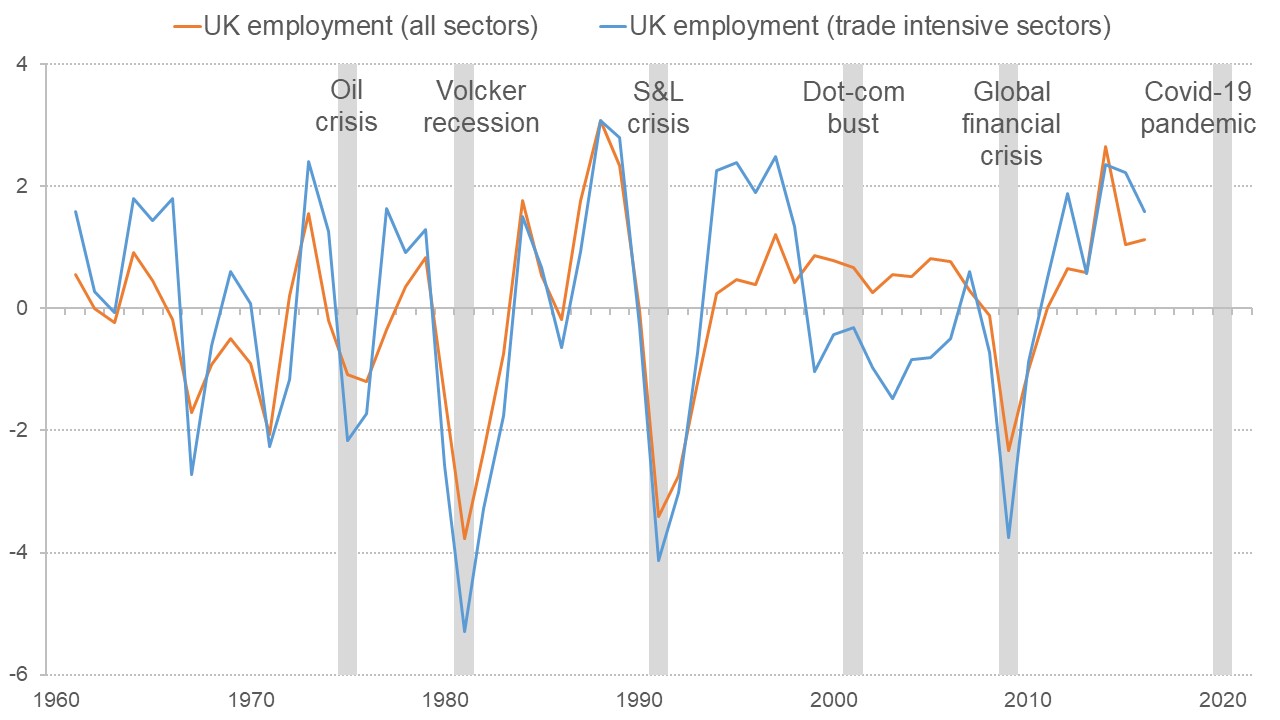

Figure 2 plots the annual growth rates of overall UK employment since 1960 (orange line), and of UK employment in the most trade-intensive sectors (blue line). In line with the evidence on trade described above, it shows that UK employment in trade-intensive sectors declined more than ‘average’ employment in past global downturns – but it also experienced a more vigorous recovery in the aftermath.

Figure 2: UK employment growth overall and in trade-intensive sectors since 1960

Sources and notes: Data on employment in 11 broad sectors from the Bank of England’s Millennium of Macroeconomic Data. ‘Mining and quarrying’, ‘manufacturing’ and ‘retail and wholesale distribution’ are classified as the most trade-intensive sectors, based on 2017 ONS sector-level statistics on exports and imports per worker. Detrended employment growth is the year-on-year growth rate net of average employment growth during the 1960-2016 period. Global downturns (blue-shaded areas) are defined as in Freund (2009): world real GDP growth below 2%, and at least 1.5 percentage points below the average of the previous 5 years.

As the world enters the Covid-19 recession, UK policy-makers should be mindful that firms and workers in trade-intensive sectors were hit harder by past global downturns than the rest of the economy. It seems likely that this will be the case again over the coming months.

At the same time, UK exporters and importers face particularly high uncertainty over their future access to international markets. This is because the government is yet to define new economic relationships with the EU and other major economies in the wake of Brexit. Policy-makers would do well to ensure that this process does not cut off the UK’s trade-dependent jobs from the eventual global recovery.

What else can I read?

The Greater Trade Collapse of 2020: Learnings from the 2008/09 Great Trade Collapse: Richard Baldwin argues that 2020 will experience a trade collapse far larger than 2008/09 since the ‘Covid concussion’ is both a demand shock and a supply shock.

Trade set to plunge as Covid-19 pandemic upends global economy: The World Trade Organisation’s forecast for world merchandise trade in 2020-21.

The pandemic adds momentum to the deglobalisation trend: Douglas Irwin reviews the history of globalisation, showing that trade globalisation appears to have peaked in 2008 and that the Covid-19 pandemic may hasten a recent trend of ‘deglobalisation’.

Tracking trade during the Covid-19 pandemic: Diego Cerdeiro, Andras Komaromi, Yang Liu and Mamoon Saed of the IMF explain how to use real-time maritime traffic data to track what is happening to global trade.

Who are UK experts on this issue

- Kalina Manova, University College London, has published on the role of credit conditions in the ‘Great Trade Collapse’.

- Robert Zymek, University of Edinburgh, has published on trade in the wake of sovereign defaults and is currently working on the origins of bilateral trade imbalances.

- Natalie Chen, University of Warwick, has worked on the quality of goods and the ‘Great Trade Collapse’.

- Morten Ravn, University College London, works on business cycles and has conducted research on the key ‘business cycle facts’ across countries.

- Silvana Tenreyro, London School of Economics and Bank of England, works on trade and income volatility and has published on estimating the determinants of global trade.